Table of Contents

Whether you file your taxes yourself or employ a professional accountant, the first step in the process is to gather all of the information you’ll need to fill out your tax forms. Getting a better understanding of our tax law and making use of as many deductions and credits as possible might save you thousands of dollars, while it’s unlikely to half your tax payment.

The following are seven things you should consider for managing your tax.

7 Things you should Add for Managing your Tax Checklist

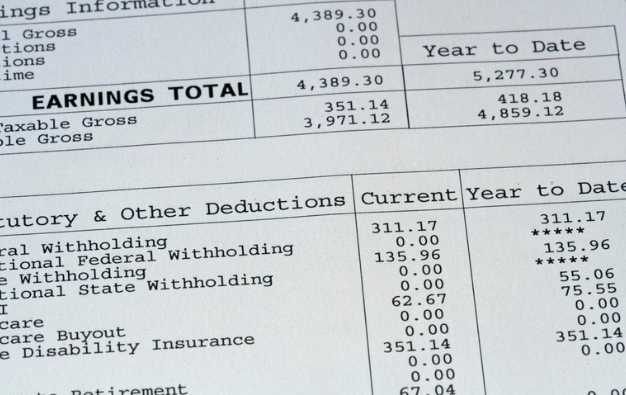

1. Use of a pay stub maker

This is the first you could need to prepare your tax return. Each pay stub contains year-to-date entries for each withholding category, allowing you to keep track of how much you’ve paid in business taxes, Social Security, and Medicare over the year. Many firms offer a comparable list for contributions to retirement savings programs and health plans. These fields are usually denoted by the term “YTD” (year-to-date) on your pay stubs.

This is the first you could need to prepare your tax return. Each pay stub contains year-to-date entries for each withholding category, allowing you to keep track of how much you’ve paid in business taxes, Social Security, and Medicare over the year. Many firms offer a comparable list for contributions to retirement savings programs and health plans. These fields are usually denoted by the term “YTD” (year-to-date) on your pay stubs.

You must notify any inaccuracies in your deductions. The last thing you want is a mistake to occur several times throughout a pay period. Don’t hesitate to get in touch with your payroll provider if you have any queries regarding the information on your pay stub.

You may use a pay stub maker to produce a paystub in less than 2 minutes. To use our paystub calculator program, you only need to provide the company name and your salary details.

It’s important to note that creating your pay stubs is legal, and you can do it quickly and effortlessly with paystub Maker. It is, however, prohibited to use a pay stub maker to manufacture fraudulent pay stubs to apply for loans and other things.

2. Tax documents

It’s all about forms at the IRS. You can access and print almost every tax form on the IRS website, but if you’re doing your taxes on your computer like many others, you won’t need the paper forms. You may either fill out forms online or have a software tool question you for information and fill it in for you. It’s a good idea to file your taxes online if you want to collect your return sooner.

It’s all about forms at the IRS. You can access and print almost every tax form on the IRS website, but if you’re doing your taxes on your computer like many others, you won’t need the paper forms. You may either fill out forms online or have a software tool question you for information and fill it in for you. It’s a good idea to file your taxes online if you want to collect your return sooner.

Today, the pandemic has also increased the number of home renovation to give way for home offices. One Click Life mentioned that in Australia, home extensions and improvements that are deemed necessary for work and business can be filed as part of your working from home tax deduction. So, make sure to keep those renovation receipts and documents for tax filing.

3. Personal Information

You’ll need your Social Security or tax ID number, as well as the numbers of your spouse and any dependents and documents of any child care you paid for throughout the year, including the care provider’s tax ID number.

You’ll need your Social Security or tax ID number, as well as the numbers of your spouse and any dependents and documents of any child care you paid for throughout the year, including the care provider’s tax ID number.

4. Proof of your earnings

Get your records and papers ready since you’ll need to account for all of the money you earned throughout the tax year. If you’re self-employed, you’ll need your W-2 tax forms for the previous year. If you’re jobless, you may have unemployment income to report, which you will document on a 1099-G form sent to you by your state.

Get your records and papers ready since you’ll need to account for all of the money you earned throughout the tax year. If you’re self-employed, you’ll need your W-2 tax forms for the previous year. If you’re jobless, you may have unemployment income to report, which you will document on a 1099-G form sent to you by your state.

Your tax situation will almost certainly be more difficult if you’re self-employed. You may have one or more 1099-MISC forms, as well as K-1 schedules and other income documents. You may also have income from sources that don’t send you proper tax forms but that you must declare, so keep careful records throughout the year. You’ll also need documents if you’ve made due tax payments during the year.

You may have rental income to declare if you own investment property (plus rental-related expenses). You’ll also need details on your rental property, such as its cost, depreciation, and when it was put into service, among other things.

Social Security income is reported on a 1099-SSA form, whereas retirement income from a pension market, IRA, or annuity is written on a 1099-R paper. (Income from the Railway Retirement Board is reported separately, the 1099-RRB.) Any dividends or interest received (through forms 1099-DIV and 1099-INT, respectively) and investors must report any income from trading stocks or real estate transactions (papers 1099-B and 1099-S, respectively). To calculate your capital gains or business losses on assets you sell, you’ll need to know when you acquired them and what your cost basis was (assuming it wasn’t recorded on a 1099-B). You’d need a 1099-SA or a 1099-LTC if you received payments from an HSA or long-term care.

Those aren’t your only options for earning money, either. Gambling profits (which are frequently reported on a W-2G form), hobby income, royalties, alimony, and honours or awards are just a few others. Keep solid notes throughout the year, so you’re ready to report any of these that relate to you.

5. Itemized deductions and receipts for charitable donations

Ensure that you receive receipts for any charitable contributions you made throughout the year.

For any itemized deductions, you should gather your tickets as well. Consult your accountant for information on the kind of items to look for. Most individuals would save more money by using the standard deduction rather than itemizing all of their beliefs, but if you have enough individual opinions, listing them out might lower your tax obligation dramatically.5. Hiring a tax professional or using software

This may seem not very comforting, but if you’ve been classifying your transactions throughout the year, you can produce a Schedule A report using Quicken with only a few clicks. It will be listed with your tax returns. Ensure there’s a tax line item connected with any custom categories that aren’t showing up on your Schedule A or Tax Summary report. (If you’re using Quicken for Windows or Mac, here’s how to accomplish it.) You can always construct your custom category report to see those transactions.

6. Medical insurance

Your health insurance company should send you evidence of coverage via mail. Make sure that you have all of the necessary papers. Also, if you had a lot of medical bills last year, keep track of them. Using an online paystub maker as an expenditure report is a convenient way to keep track of your expenses in one location. Medical expenditures are not always tax-deductible, but you can claim them if they account for a significant portion of your total income.

Your health insurance company should send you evidence of coverage via mail. Make sure that you have all of the necessary papers. Also, if you had a lot of medical bills last year, keep track of them. Using an online paystub maker as an expenditure report is a convenient way to keep track of your expenses in one location. Medical expenditures are not always tax-deductible, but you can claim them if they account for a significant portion of your total income.

7. Proof of payment of additional taxes

Keep track of any additional taxes you pay throughout the year. The following are the most important:

- Taxes on the federal level

- Taxes paid by the state

- Taxes on real estate

- Other ad valorem taxes (like vehicle registration)

- Sales tax on big-ticket purchases.

Using a technology partner such as an online paystub maker, you can easily keep track of this evidence of payment.