Table of Contents

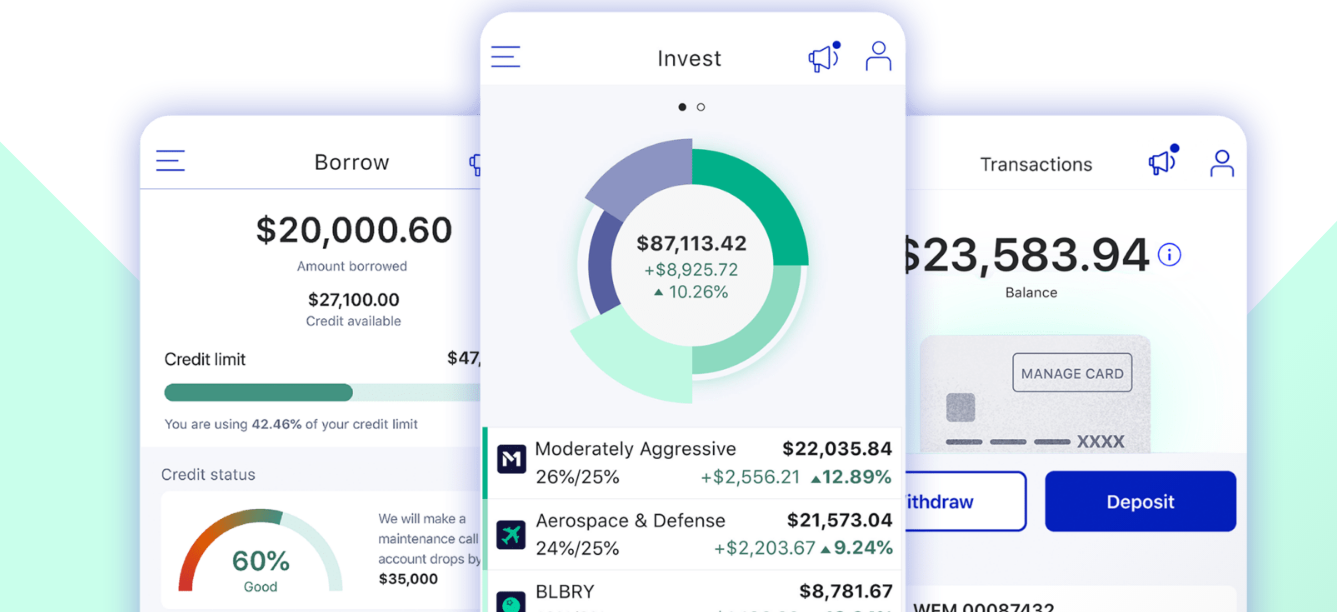

M1 Finance is a Financial Tech firm providing various financial solutions to lend, invest, save and spend. You may access your items through the website of the company as well as smartphone apps (available on Android and iOS devices). Users may design a highly personalized strategy for their investments that meets their individual goals and financial condition. They can either design their strategy mix or invest in over 80 portfolios prepared by experts. The M1 Invest allows users to invest in equities (both fractional and whole) as well as ETFs. Personal, joint, IRA/trust funds can be used for the investment. In this blog, you will find how does M1 finance makes money and the various features involve in M1 Finance and the history of M1 finance.

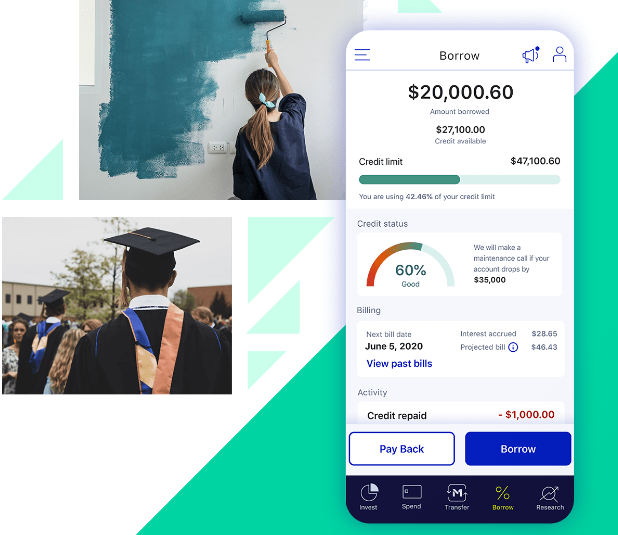

If you want to keep your time to a minimum, you may utilize Auto Investment. You can accomplish that. Users can have access to the corporation’s loans through M1 Borrow. Users can draw up to 35% of their investments. Every user whose trading account has invested $10,000 more than is entitled to make a loan. M1 Spend enables customers to apply using the linked debit card for a bank account (issued by Lincoln Savings Bank). In addition to cash withdrawal or item payment, you may also earn APY, as well as reward benefits, using your account and card. In addition to purchasing things, The account is supplied with up to $250,000 FDIC protection.

History of M1 Finance

The North American M1 Finance is an online investing platform for stocks and borrowing cash (ETFs). The firm offers additional margin credit, cash flow management, and the service of checking or debit accounts. M1 Finance was created by Brian Barnes, who acquired an investment enthusiasm when his parents started a fifth-grade mutual fund on his behalf. As an adult, Barnes has been deprived of financial services. He stated that fund managers primarily concerned themselves with constructing their wealth but not with the money of customers that they had to manage.

Barnes remarked that the overall sector lacked development, was too complicated and the access hurdles were high. A reasonable price, easy and automatic investment means was developed in 2015 by the M1 Finance portal. Only after six years, the modern business had investments under the control of about $3.5 billion.

How does M1 finance make money?

M1 Finance makes money through order flows, subscription charges, money loans, exchange charges, cash interest, and short sales. Let’s take a more detailed look at each of the income streams below:

1. Payment for order flow

If a customer puts an order on the M1 Finance app, the request is sent on to a fund manager who then pays the firm for trade flow simplification. The market manufacturer here gets money from the contract as it tries to link the buyers and vendors with the same guarantee. The market maker makes the transaction easier by selling the asset if a customer starts a sales position. To earn a profit, the market operator’s selling price is lower than that offered to customers on the fair market. This profit is extremely tiny but is increased over hundreds or even millions of deals every day. M1 Finance shares a percentage of this revenue.

2. Subscriptions

M1 Finance offers $125 a year for an M1 Plus membership subscription In its three basic offerings, namely borrowing, investing, and spending, the subscription offers superior conditions. The subscription may always be terminated but remains till the 1-year barrier has been reached. This means encouraging customers to remain on the site to use its many goods to recoup the cost. The aim is to provide a paid subscription. This inspires customers to continue to use the service, which enhances M1’s contact points. Similar products are provided by competition such as Acorns or Stash Invest.

3. Lending

Users can acquire a credit line using the Borrow product of M1. The portfolio is therefore utilized as a guarantee to protect the firm from any kind of delay in payment. Borrowing money from M1 permits customers to prevent their securities from tax payments (i.e. capital gains tax). In addition, while filing business taxes, they can exclude the costs of paying the interest. A basic portfolio amount of $10,000 is necessary for users. The rate of interest is equivalent to 3.5% for primary account users and 2% for M1 Plus customers. As a result, M1 generates money for borrowers’ interest.

4. Cash’s interest

Like every conventional bank, M1 Finance uses the funds existing on customer business accounts to grant to other organizations, such as banks. These companies then generate interest (also called Net Interest Margin). Statista reported that for 2019 most US banks had a net interest income of 3.35 percent. Cash stored in investment accounts (through M1 Invest) or their cash accounts can be created via M1 Finance (M1 Spend). Cash kept by the M1 Spend accounts is guaranteed by the FDIC for up to $500,000 and cash kept by the FDIC for up to $250,000.

5. Interest on short sales

The trader assumes the security is reduced by a certain future date if it is sold shortly (the so-called expiration date). First of all, a trader must borrow this asset and sell it at the present market value from an organization (in this example a brokerage such as M1). The aim is that these securities are to be purchased again and again at a cheaper price (though not later as of the expiry date) and then returned to the lender (M1, in this case). Short sellers seek to benefit from the gap between short sell earnings and the cost of securities repurchase. This is usually called short coverage.

6. Fees for exchange

In collaboration with Lincoln Savings Bank, M1 Finance provides a VISA debit card. An interchange charge is levied whether you are paying with a debit or a credit card. This charge constitutes a proportion of the sales price payable by the trader receiving the cash. It is usually within the range of 1%. Every time the debit card is being used, M1 Finance gets a percentage of those charges. The precise proportion share is not published publicly.

Finally, the M1 finance provides many of the offers for employers, businessmen, and traders too. You can make use of the offer and avail of your loan. The complete strategy on how M1 finance makes money is discussed, leave your comment below about your opinion on M1 Finance and follow up the Live Business Blog for further updates and to know about the future trends and aspects in small business, technology, lifestyle, etc.,