Table of Contents

In today’s fast-paced world, financial technology (FinTech) companies have revolutionized how we conduct transactions and manage our money. With the widespread use of blockchain, technology, and smartphones, investing has never been easier or more accessible. As a result, there is a booming FinTech industry in India with innovative companies offering cutting-edge solutions to consumers’ financial needs. In this post, we will explore the top 10 FinTech companies in India, making waves in the industry and changing the game for all of us looking for the best fintech companies near you!

Top 10 FinTech Companies in India

1. Paytm

- Paytm is one of India’s most popular FinTech companies, founded in 2010 by Vijay Shekhar Sharma. Initially starting as a mobile recharge and bill payment platform, it has now expanded to offer various financial services, including digital wallet, UPI payments, online shopping, insurance and even mutual funds.

- Paytm has revolutionized how people transact money in India with its easy-to-use app that can be accessed on smartphones and feature phones. With over 350 million registered users and over 20 million merchants accepting Paytm payments, it has become an integral part of daily transactions for many Indians.

- One of Paytm’s biggest strengths is its commitment to secure transactions through state-of-the-art technology such as blockchain. It also offers cashback rewards and discounts on its platform, which has helped build customer loyalty.

- In addition to its financial services offerings, Paytm supports various social causes like education for underprivileged children through donation campaigns on its app.

- Paytm’s success proves that innovation coupled with a customer-centric approach can disrupt traditional business models.

2. Lendingkart

- Lendingkart is a FinTech company in India that provides SMEs easy access to capital. They use technology and data analytics to evaluate small businesses‘ creditworthiness, allowing them to give loans quickly and efficiently.

- One of Lendingkart’s most significant advantages is its ability to disburse funds within 72 hours of receiving an application. This makes them an excellent option for small businesses needing immediate cash flow.

- Another benefit of using Lendingkart is its personalized approach to lending. They consider various factors, such as location, industry, years in business, etc., when evaluating loan applications. This means they can offer customized solutions for each business’s unique needs.

- Furthermore, Lendingkart has a user-friendly online platform where borrowers can easily apply for loans & manage their accounts. Their platform also offers features such as automated repayment reminders and real-time loan status tracking.

- Lendingkart is one of the top FinTech companies in India due to its innovative approach towards lending and its focus on providing fast and efficient services for SMEs.

3. Instamojo

- Instamojo is a Bangalore-based fintech company providing small businesses with digital payments and e-commerce solutions. This platform enables small enterprises to quickly sell their products or services online without needing technical skills.

- Instamojo’s simple, user-friendly interface allows business owners to create an online store within minutes and start selling products immediately. The company also offers various payment modes like credit cards, debit cards, net banking and mobile wallets, making it convenient for customers to pay as per their preference.

- The platform also provides value-added services like logistics support and sales analytics for better decision-making by the seller. As a result, Instamojo has been recognized globally as one of India’s most innovative startups in fintech.

- In addition, they have implemented blockchain technology in their platform, providing transparent transactions across all parties involved. This ensures security against fraudulent activities leading to customer trust in this platform.

- Instamojo has revolutionized how small businesses operate digitally by providing efficient tools that enable them to compete with larger companies through accessible technology at affordable prices.

4. MoneyTap

- MoneyTap is a leading online lending platform in India. It offers personal loans of up to Rs 5 lakh with flexible repayment options and interest rates starting from as low as 13%. The company was founded in 2016 and has quickly gained popularity due to its user-friendly interface and quick loan disbursal.

- One of the unique features of MoneyTap is its credit line facility, which allows customers to use their approved credit limit on the go via a mobile app. In addition, customers can borrow any amount within their credit limit whenever they want and pay only for what they use.

- MoneyTap also offers instant approval on personal loan applications with minimal documentation requirements. This makes it a seductive option for those who need cash urgently or do not have extensive financial records.

- The company has partnered with various banks & NBFCs to offer customized loan products that meet the diverse needs of customers across different income levels. With over one million downloads on Google Play Store, MoneyTap is undoubtedly one of the best fintech companies near me that provides easy access to credit facilities through blockchain technology, smartphone apps, and other innovative technologies.

5. Razorpay

- Razorpay is a popular payment gateway solution in India that offers merchants an easy and hassle-free way to accept online payments. The company was founded in 2014 by Shashank Kumar and Harshil Mathur, who wanted to solve the problem of unreliable payment gateways.

- What sets Razorpay apart from other payment gateway providers is its user-friendly interface, quick onboarding process, and a vast range of payment options, including credit/debit cards, net banking, UPI, and various wallets. This makes it an ideal choice for small businesses looking for a reliable payment solution.

- Razorpay has also made significant strides in cashless transactions with features like recurring payments, subscriptions, and invoicing solutions. In addition to this, the company has integrated AI-powered fraud prevention tools that ensure secure transactions.

- Razorpay’s innovative features, coupled with its commitment to providing excellent customer support, have made it one of the top fintech companies in India today.

6. Shiksha Finance

- Shiksha Finance is a leading fintech company in India that provides financial assistance to students who want to pursue their education but need the necessary funds. The company was founded in 2016 and has helped many students achieve their academic goals.

- What makes Shiksha Finance unique is its mission to bridge the gap between deserving students and quality education by providing affordable loans. The company uses advanced technology and data analytics to evaluate a student’s creditworthiness, making it easier to secure loans without collateral or a guarantor.

- Shiksha Finance offers flexible repayment terms, which means students can repay their loans once they start earning after completing their education. This approach has made it possible for many underprivileged students who would have otherwise been unable to afford higher education.

- Shiksha Finance is an excellent example of how fintech companies use technology and innovation to improve education access in India significantly.

7. Pine Labs

- Pine Labs is a leading merchant platform and provider of payment solutions in India. Founded in 1998, the company has grown significantly, establishing itself as a reliable player in the FinTech space.

- One of Pine Labs’ standout products is its point-of-sale (POS) machines that enable merchants to accept payments through various methods such as debit cards, credit cards, mobile wallets and more. In addition, their ability to process transactions without internet connectivity sets these devices apart from others on the market.

- In addition to POS machines, Pine Labs also offers digital payment solutions for online transactions. For example, the company’s Pay Later feature allows customers to buy now and pay later at select partner stores.

- Pine Labs’ innovative use of technology has earned it several hon, including being named one of India’s most innovative companies by Fast Company in 2019. Its success can be attributed to its cutting-edge products and its commitment to customer service and support.

- Pine Labs continues to make strides in revolutionizing how payments are made across India with its user-friendly technology and exceptional services.

8. ZestMoney

- ZestMoney is a Bangalore-based fintech company that provides instant and hassle-free credit to consumers for online purchases. In addition, the company has developed a unique platform that offers digital EMI options to customers who want to purchase but may need more funds upfront.

- ZestMoney’s lending process involves minimal documentation, quick approval, and flexible repayment options. Customers can avail of loans up to Rs 5 lakhs without collateral or prepayment charges.

- The company’s partnership with leading e-commerce platforms such as Flipkart, Amazon, and Myntra has helped it expand its customer base rapidly. By enabling easy access to credit at the checkout page on these websites, ZestMoney has made online shopping more affordable for millions of Indians.

- With its innovative use of technology and data analytics, ZestMoney aims to increase financial inclusion in India by providing credit solutions that are accessible and affordable for all. Its user-friendly interface, transparent policies and excellent customer service have earned it a name as one of the best fintech companies in India today.

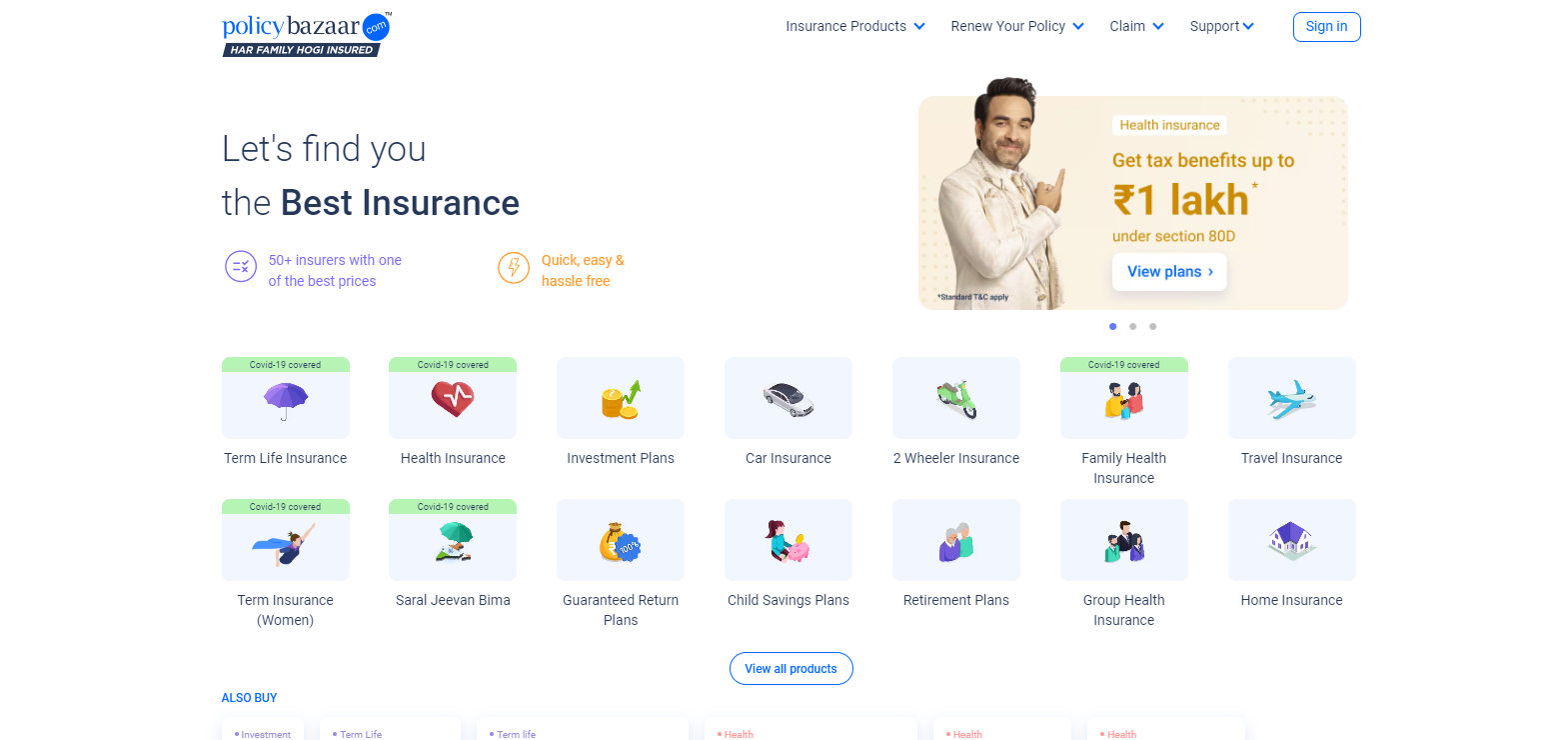

9. PolicyBazaar

- PolicyBazaar is one of India’s leading FinTech companies that offers its customers a comprehensive range of insurance products. With over 100 million customers, PolicyBazaar has emerged as a market leader in providing customized insurance solutions.

- The company uses advanced technology and data analytics to provide personalized customer recommendations based on their requirements. PolicyBazaar’s user-friendly platform makes it easy for customers to compare different policies and choose the best one according to their needs.

- In addition, PolicyBazaar also offers assistance in the claim settlement process, ensuring hassle-free transactions for its customers. Furthermore, the company has partnered with several leading insurers in India, making it easier for users to access a wide range of policies from different providers on a single platform.

- PolicyBazaar’s innovative approach towards simplifying the insurance buying process has made it one of the most trusted brands among Indian consumers. The company’s customer-centric focus and cutting-edge technology set it apart from others.

10. InCred

- InCred is a financial services platform that influences technology & data to deliver customers personalized and hassle-free loans, credit cards, and other financial products. The company offers a range of lending solutions for personal, business, education, healthcare, and consumer durables needs with flexible repayment options.

- One of the unique features of InCred is its proprietary underwriting model that uses artificial intelligence (AI) algorithms to determine creditworthiness based on 1,000+ parameters. This enables InCred to offer competitive interest rates and faster processing times than traditional banks.

- In addition to lending, InCred provides insurance products such as life and health insurance through strategic partnerships with leading insurers. Customers can use these products online or through the company’s branch network across India.

- InCred’s customer-centric approach, coupled with its cutting-edge technology, makes it one of the top fintech companies in India today.

Conclusion

To sum up, the fintech industry in India is rapidly growing & evolving with new technologies such as blockchain, AI and machine learning. These technologies have enabled companies to offer innovative financial products & services that cater to the needs of a diverse customer base.

The top 10 fintech companies listed above are just a few examples of how technology can revolutionize the financial sector. From digital payments to lending solutions, these companies are making finance more accessible, affordable and convenient for everyone.

As India embraces digitalization, we can expect more exciting developments in fintech. With advancements in technology like smartphones and investing tools, it’s an exciting time for consumers and investors alike.

So if you’re looking for the best fintech companies near you, check out these top 10 players leading the charge in India’s dynamic fintech landscape!